41+ insurance to pay off mortgage upon death

How do you pay off mortgage with life insurance. Great Protection and Stackable Discounts.

Pdf Reform Of The Social Sphere Institutional Barriers At The Regional Level Sergey Shulgin Academia Edu

Web However mortgage protection insurance has certain key drawbacks.

. Get both from COUNTRY Financial. 100 No-Hassle Online Process. Benefit amounts up to 1M.

Ad Exclusive term life insurance from New York Life. Get a Free Quote. Web Get more info about insurance that pays off mortgage upon death.

The Estate Trustee or surviving spouse or partner will have to make sure that the lender discharges the mortgage. Ad Affordable coverage with an easy online application process. Protect Your Loved Ones from Debt Liability.

Top 5 Life Insurance of 2023. Web Term life insurance covers you for a specific amount of time such as 20 years which might be sufficient to protect you while you pay off your mortgage. Web 38 Life Insurance That Pays Off Mortgage - Krystalskreativityan.

A Rated Term Policies From 738Month. Web Mortgage life insurance is a life insurance policy that pays the balance remaining on your mortgage if you die before your home is paid off. These policies differ from traditional life insurance policies.

Web Mortgage life insurance also known as decreasing term life insurance pays a lump sum on your death to help pay your repayment mortgage. Web Mortgage protection insurance pays the death benefit directly to the lender to pay off your mortgage. Web Mortgage Life Insurance.

1 But the stakes can be higher with housing debt because family. Life Insurance Study which takes into account factors such as consumer satisfaction and customer service. As Low As 349 Mo.

Although this exact surcharge will depend upon the value of your home it. The premiums are generally more affordable than a whole life policy because the coverage. No Medical Exam - Simple Application.

Up to 150000 in coverage. Power ranked State Farm the number one life insurance carrier in its 2021 US. On your death.

Web 1 Answer There is a special type of life insurance policy available known as a mortgage life insurance policy that will pay off your home in case of your demise. This type of coverage is required by some lenders and typically pays directly to the company. Web Mortgage Protection Insurance One option for avoiding issues with your mortgage if you die is to purchase mortgage protection insurance also sometimes called mortgage life insurance.

Get the Best Mortgage Life Insurance. Provide protection for your family in the event of an unexpected covered accident. Life Insurance You Can Afford.

Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency. Web Upon the death of the insured the insurance company will pay the lender the amount needed to pay off the mortgage in full. Ad Buy up to 2000000 of Mortgage Insurance w No Exam.

However in the last few years a new type of life insurance. An insurance policy designed specifically to repay mortgage debt in the event of the death of the borrower. Top 10 Reliable Affordable Plans.

Web Private Mortgage Life Insurance. You can usually purchase a mortgage life insurance product from a life insurance company where you are the owner and can name your own beneficiary. The loan still exists and needs to be paid off just like any other loan.

This coverage is often offered by your bank or mortgage lender but you can also. Compare Plans to Fit Your Budget. Ad Youll Sleep Better Knowing Your Mortgage is Insured.

Ad For Final Expenses. Web What Happens to Debt at Death. Unlike regular life insurance which is paid to your.

That differs from traditional life insurance which makes payment to a beneficiary you have named. No Medical Exams No Wait. For decades many Americans choose life insurance over their mortgage thinking that their insurance policy is better.

Mortgage protection insurance is different from private. No Medical Exam - Simple Application. Mortgage Life Insurance Pay Off Your Mortgage After Death Valuepenguin Is Mortgage Insurance Better Than Life Insurance To Pay Off A Mortgage Upon Death Pay Off Your.

A mortgage life insurance policy is typically a decreasing term life policy which means that the amount. Purchase a term life insurance policy for at least the. Compare Plans to Fit Your Budget.

Ad COUNTRY Consistently Receives High Ratings For Financial Strength And Client Loyalty. Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency. This type of insurance is generally added onto your total monthly mortgage premium.

Ad Compare Top 5 Mortgage Life Insurance 2023. Web Mortgage life insurance or mortgage protection insurance refers to a set of life insurance products that are designed to pay your outstanding mortgage balance if you die. For starters it can be expensive.

The death of a borrower changes things but perhaps not as much as youd think. Help protect your loved ones with valuable term coverage up to 150000.

Free 41 Application Forms In Ms Word

Mortgage Life Insurance Pay Off Your Mortgage After Death Valuepenguin

Pdf Metropolitan Segregation And The Subprime Lending Crisis

Mortgage Life Insurance Explained Forbes Advisor

Can You Take A Life Insurance Policy Out On Anyone

This Woman Feels Like Her Ob Is Showing Genuine Concern And Worry For Her Health And Her Baby S Health But She S Letting These Women Convince Her Otherwise I Hope Someone Can Get Through To Her R Shitmomgroupssay

Business Succession Planning And Exit Strategies For The Closely Held

Financial Literacy Its Effects On Micro Insurance Uptake Grin

What Happens To A Home Loan If The Borrower Dies

How To Use Life Insurance To Pay Off Your Mortgage Early Runstedler Life Retirement

Mortgage Protection Insurance Don T Be Fooled You Need It

How Long Does It Take To Get A Life Insurance Payout

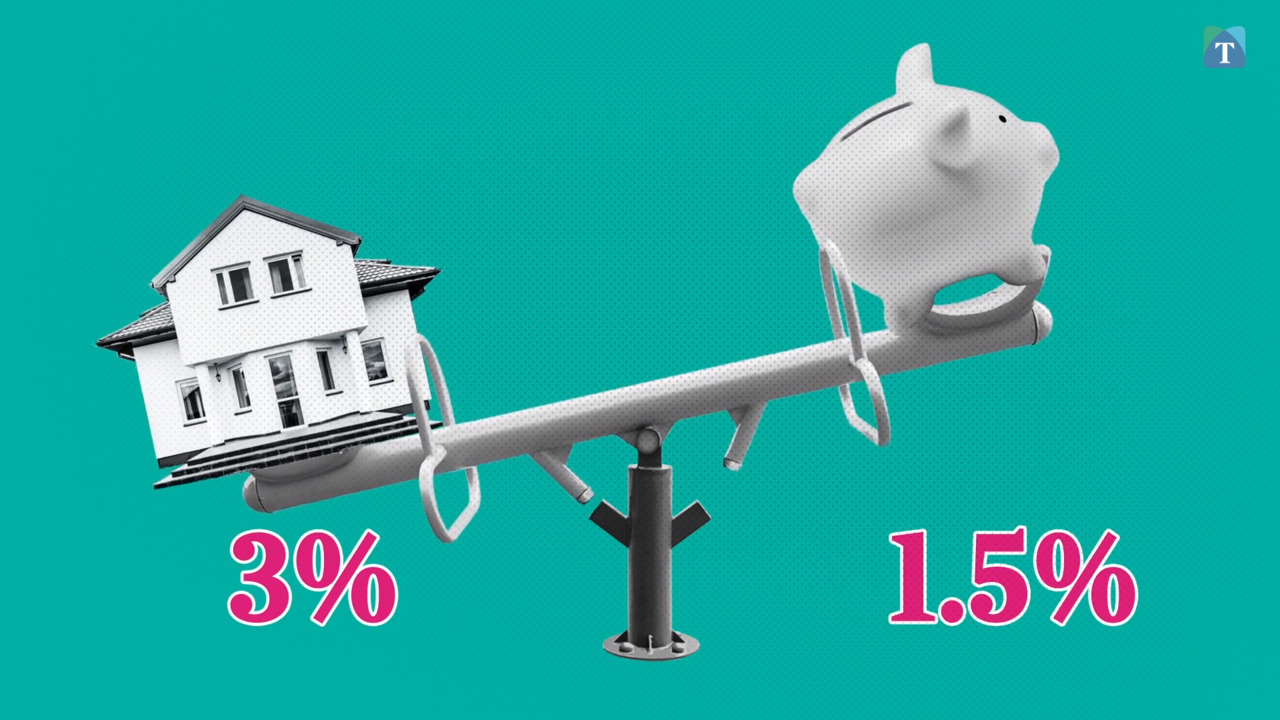

How Does Mortgage Life Insurance Work Times Money Mentor

G19664mo01i001 Jpg

Paying Off Debt With Your Life Insurance Insurancehotline Com

How To Use Life Insurance To Pay Off Your Mortgage Early Runstedler Life Retirement

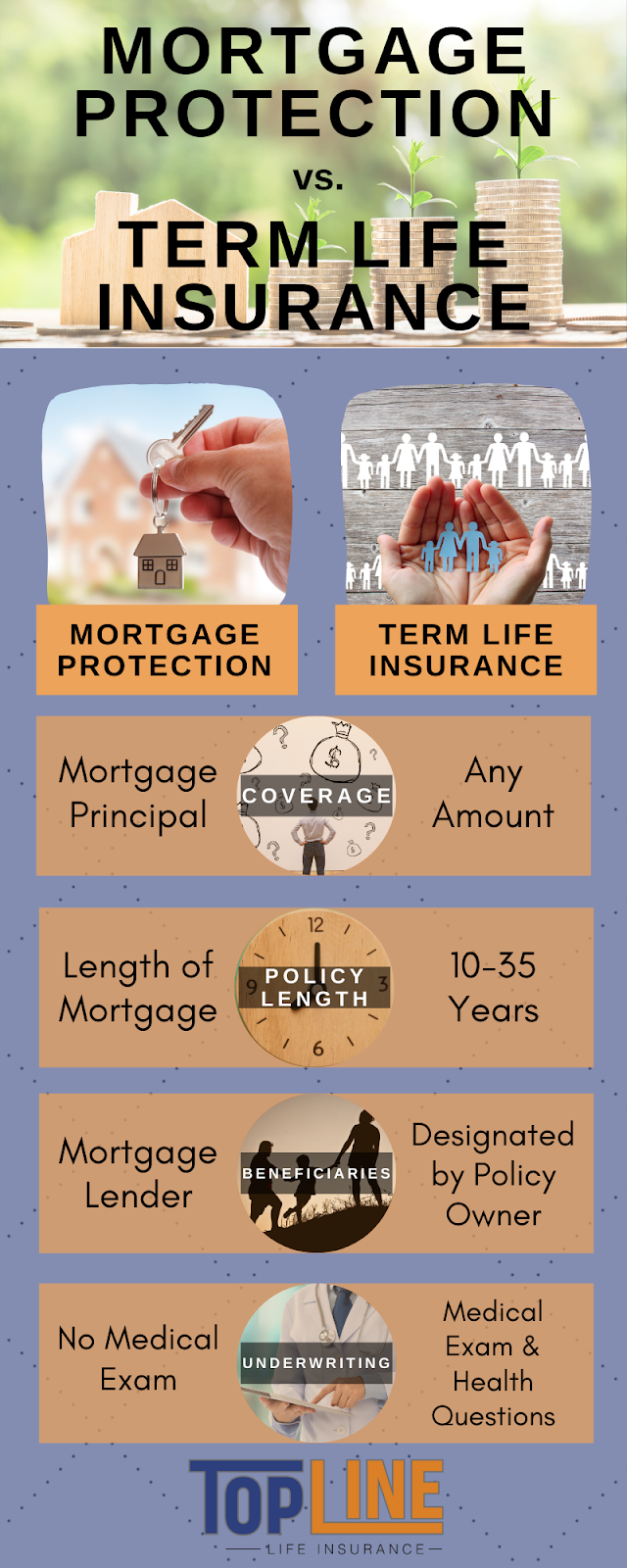

What Policy Do I Need To Pay Off My Mortgage Topline Life Insurance